Invest Wisely with The Daily Upside

In this current market landscape, we all face a common challenge.

Many conventional financial news sources are driven by the pursuit of maximum clicks. Consequently, they resort to disingenuous headlines and fear-based tactics to meet their bottom line.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable market insights that go beyond the headlines. And the best part? It’s completely free.

HOT OFF THE PRESS🔥

💰Markets Retreat as Yields Rise

Welcome to Money Masters!

Markets pulled back on Tuesday as surging Treasury yields pressured investors, signaling a potential shift after recent gains. The S&P 500, Dow Jones, and NASDAQ all closed lower, as investors anticipated key inflation data that could influence the Federal Reserve's next moves.

Let’s go.

BIG IDEA 1💡

Treasury Yields and Federal Reserve Moves

S&P 500 and Major Indices Retreat as Yields Climb

S&P 500 Pullback: The S&P 500 fell 0.3% as Treasury yields surged, pulling back from recent highs and impacting investor sentiment.

Yield Concerns: Rising yields signal investor caution ahead of new Consumer Price Index (CPI) inflation data.

Yields Surge Ahead of Key CPI Data

Ten-Year Yield Spike: Ten-year Treasury yields rose by 9 basis points as markets anticipate CPI data for further inflation cues.

Steady Inflation Expectations: Investors expect steady inflation; however, any increase may push the Federal Reserve to slow down rate cuts.

Fed’s Data-Driven Strategy: The Fed recently cut rates by 25 basis points and remains data-driven, eyeing stable economic indicators.

Tesla Soars as Investors Reassess EV Giant

Tesla’s Stock Rally: Tesla’s stock jumped 9% Monday, extending gains following Donald Trump’s victory in the 2024 election.

Investor Sentiment Shift: Investor sentiment shifted to positive, fueled by strong earnings and promising production growth forecasts for 2025.

Thesis-Changing Earnings: Tesla’s current growth is supported by a “thesis-changing” earnings report, which has encouraged hedge funds to cover short positions.

BIG IDEA 2💡

Earnings and Market Opportunities

Federal Reserve Speaks on Labor Market and Rates

Labor Market Resilience: Richmond Fed President Thomas Barkin described the U.S. labor market as resilient, signaling confidence in economic stability.

Rate Cut Expectations: Traders currently forecast a 70.7% chance of another rate cut in December, but sticky inflation could challenge that outlook.

Fed Commentary in Focus: Fed commentary remains closely watched for insights on rate strategy, especially as the economy remains robust.

BofA Survey Highlights Optimism for U.S. Stocks in 2025

Preferred Asset Class: Bank of America’s Global Fund Manager Survey shows U.S. stocks as a preferred asset class for 2025, driven by 43% of respondents.

Small-Cap and High-Yield Interest: Small-cap stocks and high-yield bonds gained favor, with U.S. growth expectations reaching the highest levels since mid-2021.

Potential Bullish Catalysts: Investors identified potential bullish catalysts for 2025, such as China’s economic rebound and potential U.S. tax cuts, although rising bond yields remain a top concern.

Earnings in Focus: Major Movers and Shakers

Home Depot’s Forecast: Home Depot stock dipped 1.3% after revising its sales forecast upward, driven by strong demand from contractors.

Shopify’s Surge: Shopify surged 20% after beating revenue estimates, while Live Nation’s Q3 profit exceeded expectations due to cost management.

Tyson Foods’ Positive Outlook: Tyson Foods rose over 6% with a promising outlook, and Netflix garnered attention as its ad-tier service hit 70 million monthly users.

Crypto Market and “Trump Trade” Propel Bitcoin Rally

Bitcoin Hits New Highs: Bitcoin hit new highs, crossing $89,000 as Trump’s win boosted crypto sentiment.

Mixed Altcoin Performance: Altcoins showed mixed performance: Dogecoin rose 40%, while SOL and MATIC experienced minor declines.

Record ETF Inflows: ETF inflows reached record levels, with BlackRock’s Bitcoin ETF seeing over $1 billion in one day, underscoring growing institutional interest.

NEWSLETTER CORNER🗞️

Subscribe To Our Friends!

FINANCIAL LITERACY CORNER📚

Learn About Money (Literally)

HEADLINE ROUNDUP🤠

Our 5 Favorite Stories

INFLATION REPORT💸

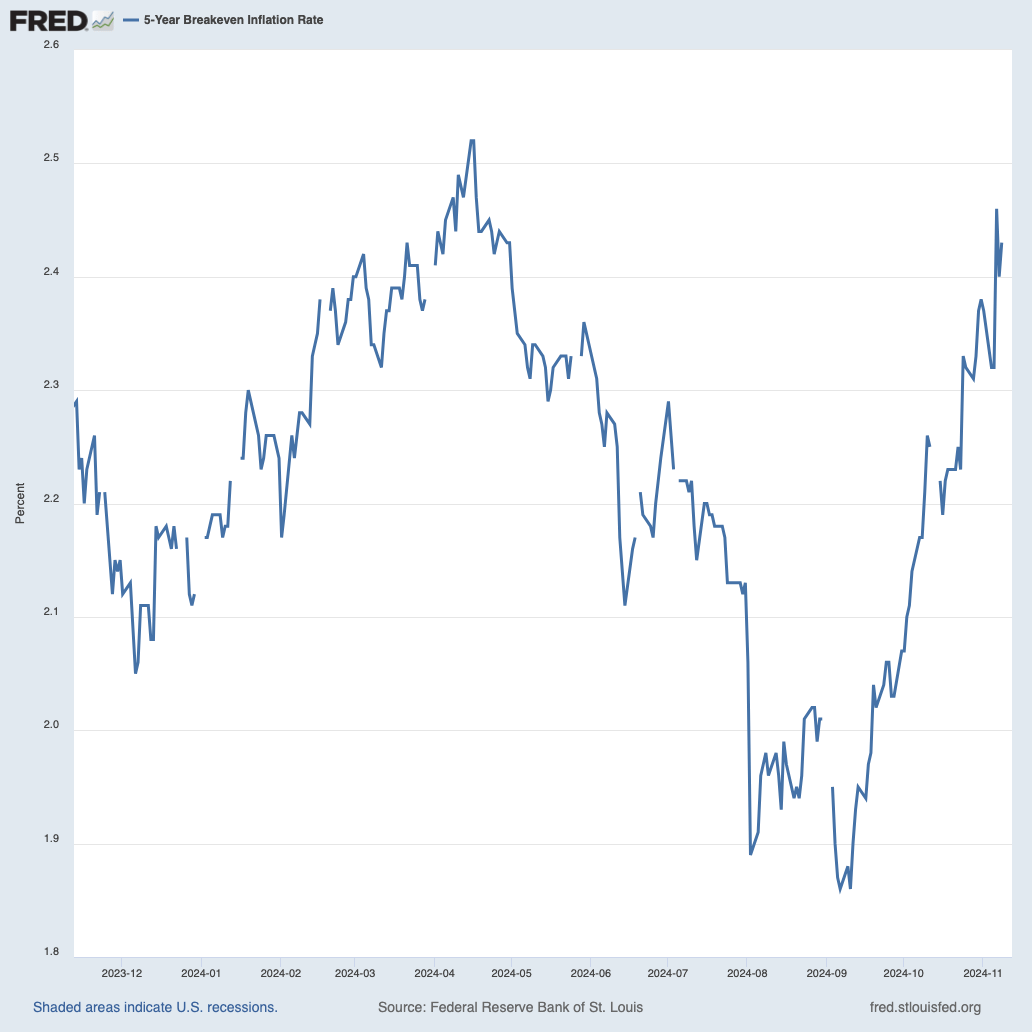

Today’s Inflation Rate: 2.42% (still climbing)

You are now closer to money mastery!🎉

What did you think of this week’s newsletter?

Did you like it? How can we improve?

Hit reply and share some feedback!

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.